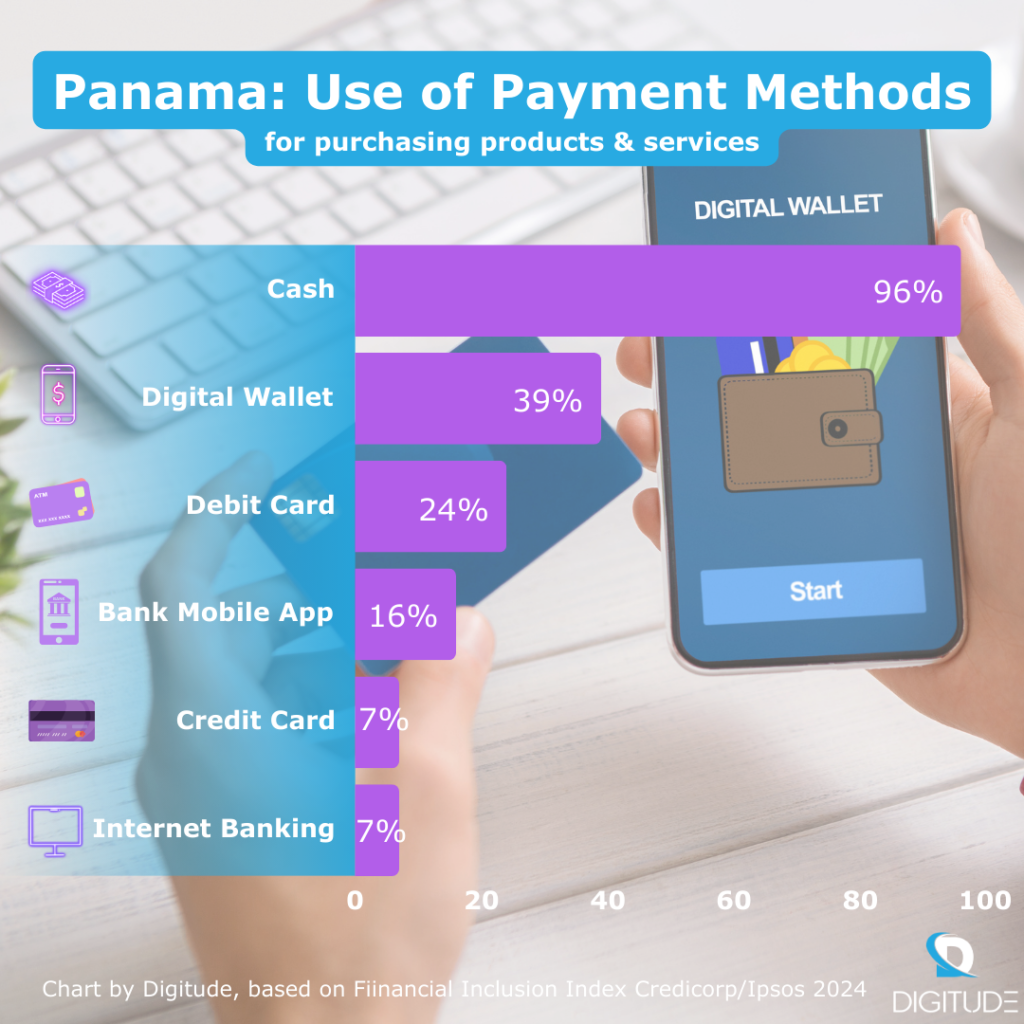

The No. 1 growth position was shared with Peru 🇵🇪 (both 14%). The use reached 39% in Panama, second to cash as payment method to purchase goods & services. Only in Argentina 🇦🇷, digital wallet use is higher (45%).

Moreover, Panama also saw the 2nd largest rise (+11%) in digital wallet ownership up to 63% of the population, ranking 2nd in ownership (close to Argentina’s 65%). The use of mobile banking apps 📱 is also relatively high (16%, second only to Chile’s 🇨🇱 27%)

This became clear from Financial Inclusion Index 2024 published end of last month by Credicorp / Ipsos of Peru. The following 8 Latin American countries were surveyed: Argentina, Bolivia, Chile, Colombia, Ecuador, Mexico, Panama and Peru (1,200 surveys per country, 5,000 in Peru).

Despite Panama’s positive results overall, there is room for improvement for a number of indicators regarding financial inclusion. E.g. 25% of salaries are received in cash, the highest percentage among the countries surveyed. Also 57% of people have a checking or savings bank account, which is just over half the population.

View the chart below for an overview of the use of payment methods in Panama to pay for products & services. The cash payments percentage (96%) is high but average for the region. The full Financial Inclusion Index 2024 is available by Credicorp / Ipsos is available here (in Spanish).