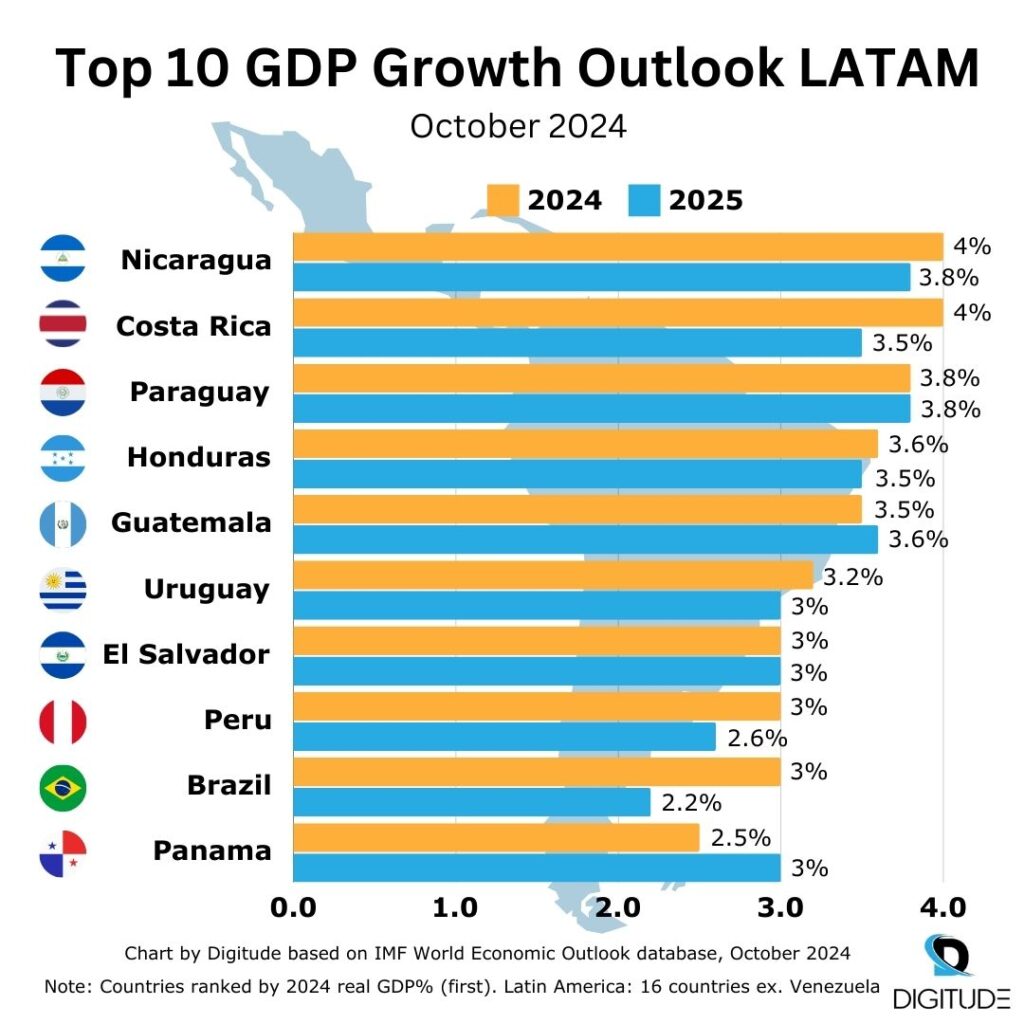

According to the latest IMF Regional Growth Outlook, that was published last Friday, the Top-3 growth countries in Latin America are forecasted to be Nicaragua (4% in 2024; 3.8% in 2025), Costa Rica 🇨🇷 (4% in 2024; 3.5% in 2025) and Paraguay (3.8% and 3.8%). Panama’s growth is expected to remain at 2.5% this year (3% for next), equal to the IMF’s April projection. Panama ranks 10th out of 16 Latin American countries regarding forecasted growth for 2024.

Economic growth in Latin America and the Caribbean (LAC), excluding Argentina and Venezuela, is projected to slow down, dropping from 2.6% in 2023 and 2024 to 2.2% in 2025. Persistent challenges, including low investment levels, weak productivity growth and changing demographics, continue to affect the region.

The largest Latin American economies Brazil 🇧🇷 and Mexico 🇲🇽 are anticipated to have growth rates of 3% and 1.5% in 2024 and 2.2% and 1.3% in 2025. Colombia’s 🇨🇴 growth is expected to rise from 1.6% in 2024 and 3% in 2025.

Compared to the rest of Latin America, Growth in Central America remained relatively strong in early 2024, powered by remittances in El Salvador, Guatemala, and Honduras and and solid export performance in Costa Rica and Panama.

Earlier this month the The World Bank published their Latin America and the Caribbean Economic Review (Oct 2024). Their forecast for 2025 was more positive with 2.6% growth for 2025 (1.9% in 2024). The higher growth expectation compared to the IMF one was primarily attributed to the declining interest rates and decreasing inflation. The higher 2025 growth forecast is also reflected in higher expected growth rates for most countries. The reasons for the limited growth were broadly similar to those in the IMF report.

An addition were the high liquidity risks and low credit quality in Panama’s Banking Sector.

High liquidity Risks & low credit quality in Panama’s banking sector &

While capital buffers remain strong in most of Latin America (including Panama), liquidity risk has increased. For Panama, all three liquidity ratios are marked as high-risk.

The loans-to-deposits ratio (149.9%) is the the 4th highest in LATAM after Argentina, Colombia and Paraguay and the coverage ratio of short-term assets against liabilities (28.3%) is the 3rd lowest in LATAM (only Paraguay and El Salvador are lower).

Furthermore, credit quality in Panama has deteriorated. The non-performing loans NPL-ratio (proportion of loans not meeting their scheduled payments) is with 5.7% the highest in Latin America.

View the IMF Regional Economic Outlook: Western Hemisphere (Latin America & the Caribbean)

View The World Bank Latin American & the Caribbean Economic Review October 2024